It’s still very common to be answered with blank looks and shrugs when questioning a client about their customers. They know exactly what the business wants but little thought has been put into who their customers are and what makes them tick. So it makes me happy to see that lately more companies are investing in contextual research. They realise that they don’t know their target market as well as they could and contextual research is the best way to rectify it… Unfortunately, there are limitations to what it can do and if that not understood upfront it can cause unnecessary stress.

1) We don’t know what we are going to find (and cover)

The thing that makes it so great is also the thing that causes anxiety for many clients. Contextual research is not a survey, it relies on open conversation with some, but little, structure. It explores areas that may not have been thought about before by allowing the conversation to go where it may. This is how it helps you to find out what you did not know, you did not know. Because of this we cannot rely on all the research topics being covered in the conversation. We plan to cover certain areas, but we cannot predict what exactly we will be able to find out. If we speak to enough people, we should cover all the topics across the group.

2) Recruits are unpredictable

We are dealing with real humans. They arrive late, forget about meetings and lie to the recruiters about who they are (yes.. this actually happens sometimes). Being a recruit a strange thing for many people and no matter how we explain it, sometimes they get scared and cancel at the last minute. If they do lie to the recruiter and are able side step the screener, luckily we work it out rather early into the session, but it’s still annoying and it takes a few days to get a replacement.

I have often forgotten to emphasise this limitation upfront to our clients, mainly because I take it for granted, but if it’s not expected, it causes a lot of stress. If a client wants to remotely watch a session and a recruit doesn’t arrive, it obviously causes them to get annoyed. We need to manage expectations and explain that we always have backups and replacements to ensure they get what they pay for, but it sometimes requires an extra day or two.

3) Findings are not a guarantee for the rest of the market segment

I’m not going to go into the ins and outs of qualitative vs quantitative research, but something to remember is that these are subjective insights that help answer why certain people do certain things in certain contexts. You cannot rely on the findings as definite data for the rest of the market segment. It will be able to tell you why people get stuck at a certain point, but it’s not reliable enough to prove that the entire market segment will definitely act in the same way.

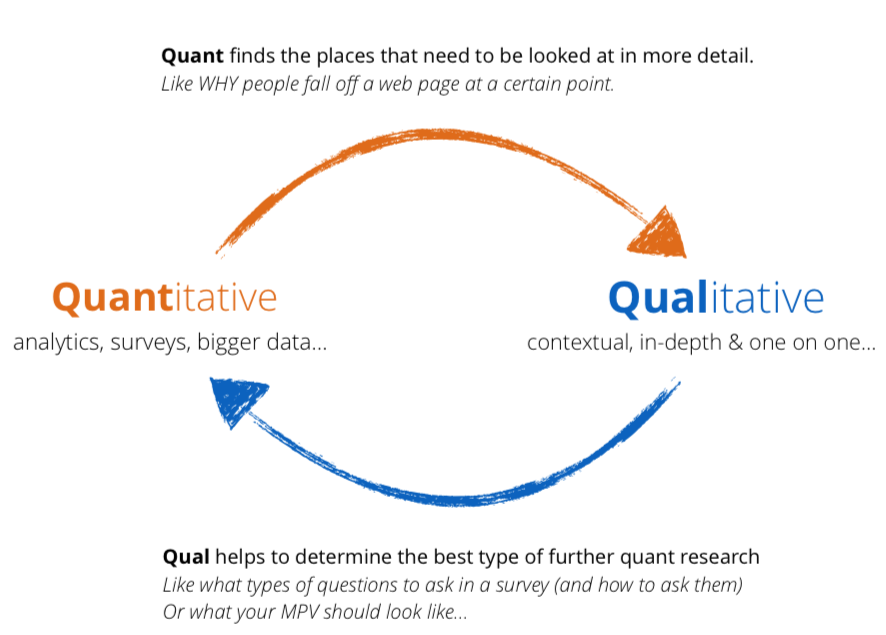

4) It shouldn’t stand on it’s own

To carry on from the last point, contextual research is truly valuable when combined with other forms of insight as it answers different questions. Analytics and quantitative data will tell what your market segment is doing but not why they are doing it. And in turn qualitative data will tell you why people do certain things, but it cannot define what they do as a whole. They need to work together and feed each other. The quantitative data will tell you where you should start looking for qualitative answers, and the qualitative findings need to drive further quantitative research.

About The Author: Chris Metcalfe

I'm not sure if I know want I want to be when I grow up. I have so far tried the entrepreneurial thing, industrial design, sound engineering and professional magic. I have been a UX designer for a decade now, so it looks like this might be it?

More posts by Chris Metcalfe