My fiancé and I are finally ready to buy a house, or at least we are mentally, but working out if we are financially prepared is something else. A while back we thought about our finances roughly and came up with a number that we think will be able to just about manage. There is currently very little stock of houses out there, so every month it’s increased just a bit more… “Oh this house is only R100 000 over the budget… Im sure can manage that!” “Maybe we can borrow more deposit from Dad”. This happened until we put in an offer that really did extend our means. It was under the asking price but we thought we could still just make it. Paranoia then started to creep… “What if there was an interest rate hike again? Or something worse?… But the house is sooo nice, its in such a nice area and its a good investment, it will be fine.. I’m sure if it will be fine…”

The counter offer came back. It was only R200 000 more than we offered… “That’s out of our budget… but what if we eat less? or drove less? or maybe borrowed from Mom?… Im sure we could make it work… “

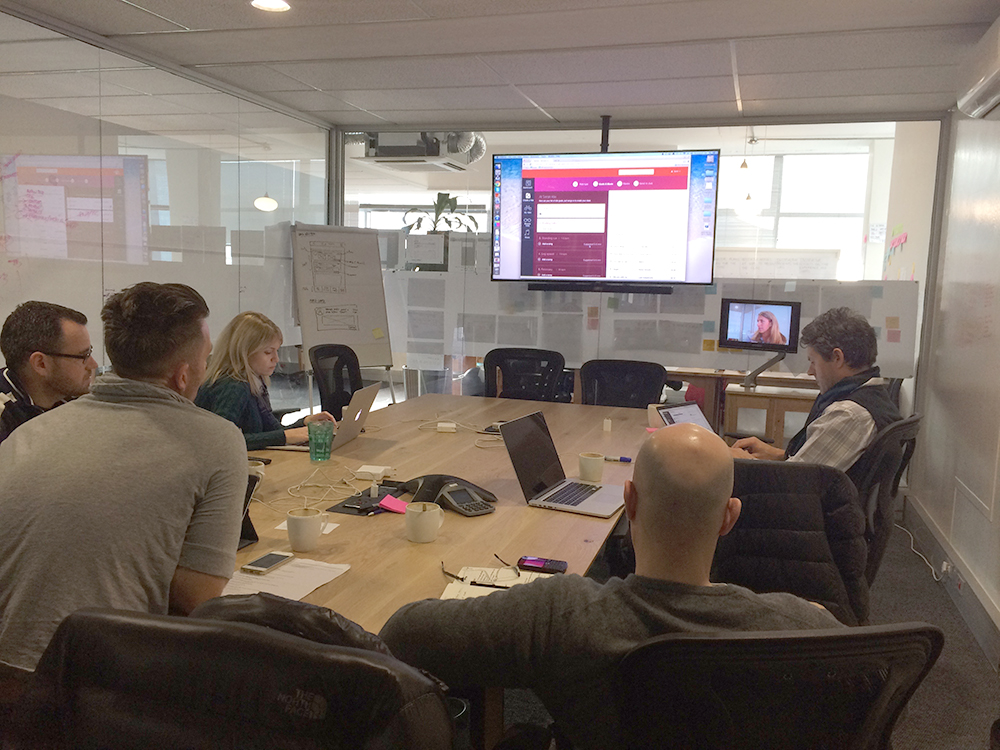

Luckly at this point, reality kicked in… we needed help. Off to Dad, he’s an accountant, he will be able to help. Dinner cooking in the kitchen and Excel open in the dining room, we started to fill in numbers. He asked how much we spend on rent, groceries, clothes… I opened 22Seven and started reading off numbers. I have all the info I needed without even realising it. It didn’t take long. Before dinner we had realised that we really really couldn’t afford the extra R2K. It was sad to say goodbye to the house we wanted, yet I was happy. It was calming to have clarity.

After dinner we started working out what we could afford… Again, all our financial numbers where at our fingertips. We worked out different scenarios; interest rate changes, paying over 20 or 30 years and what salary changes there would be other time. We came up with a number that was almost exactly what we had originally decided on so many months before. This knowledge now feels like ammo… I know exactly where the boundaries are and what we need to look for.

On the way home this got me thinking about my handle on my finances. I thought that I did not know what I could afford and needed someone to help me, but actually I did know. We knew in the beginning what we could afford. And we knew it without much effort.

I always thought that 22Seven has a lot of potential to be someone really awesome, but now I have realised that its pretty close to that already. I know what my financial position is without having to really check… I kinda just know. Now I don’t want this to sound like an advert for them, its not. It’s a realisation that I had, that having tools that just allow you to access understandable information makes decisions easier without realising it.

Maybe that is taking it a far. I was not confident enough in my original budgeting that I allowed the maximum home loan we could afford to creep, and after a while I still needed someone to check it. But I was still right in the beginning, I just needed confirmation. Now that I know actually have a handle on my my finances, I can be more confident. I don’t have to have a spreadsheet budget or an accounting degree, I just need a constant awareness of where I am financially.

That does not mean I will not go and visit Dad again for the next offer we put in, but I certainly won’t stress about it as much.

About The Author: Chris Metcalfe

I'm not sure if I know want I want to be when I grow up. I have so far tried the entrepreneurial thing, industrial design, sound engineering and professional magic. I have been a UX designer for a decade now, so it looks like this might be it?

More posts by Chris Metcalfe